- Zest Wire

- Posts

- Zest Wire | 21-January-2026

Zest Wire | 21-January-2026

What Zest's security certification means for you. Plus: news from around the region and much more.

This week’s agenda

🔒 Zest’s ISO certification

🎙️ Our Communications feature

📈 MENA records its strongest funding recovery in history

💰 Capital activity across MENA private markets

📖 What we’re reading

📆 Upcoming webinar: Building the liquidity layer for startups

Let’s dive in!

Zest is now ISO 27001 Certified: Setting the gold standard for private market security

We are proud to announce that Zest has officially achieved ISO 27001:2022 certification, validation of the Information Security Management System (ISMS) that protects every transaction on our platform.

Our certification covers the entire ecosystem of transaction processes you rely on. As we continue to scale and power the region's private markets, this certification ensures that your most sensitive data remains protected by the highest international standards.

Streamline your investor updates: A reminder on the Communications feature

Since the recent launch of Communications, we have seen a significant surge in usage across the platform as more of our users leverage this tool to engage their stakeholders. This feature was specifically built to help you share progress, reports, and commentary in one seamless flow, directly from where your deals live.

Here is a reminder of why this tool is becoming a staple in the Zest workflow:

Everything in one flow: Consolidate your progress updates, financial reports, and strategic commentary within the Zest platform, no more searching through multiple inboxes.

Built-in security: Protect your sensitive information with automated watermarks and controlled document access, ensuring your data remains confidential as you scale.

An auditable history: Every update is automatically logged on the deal, creating a clear, professional, and auditable record for future rounds or exits.

MENA records its strongest funding recovery in history

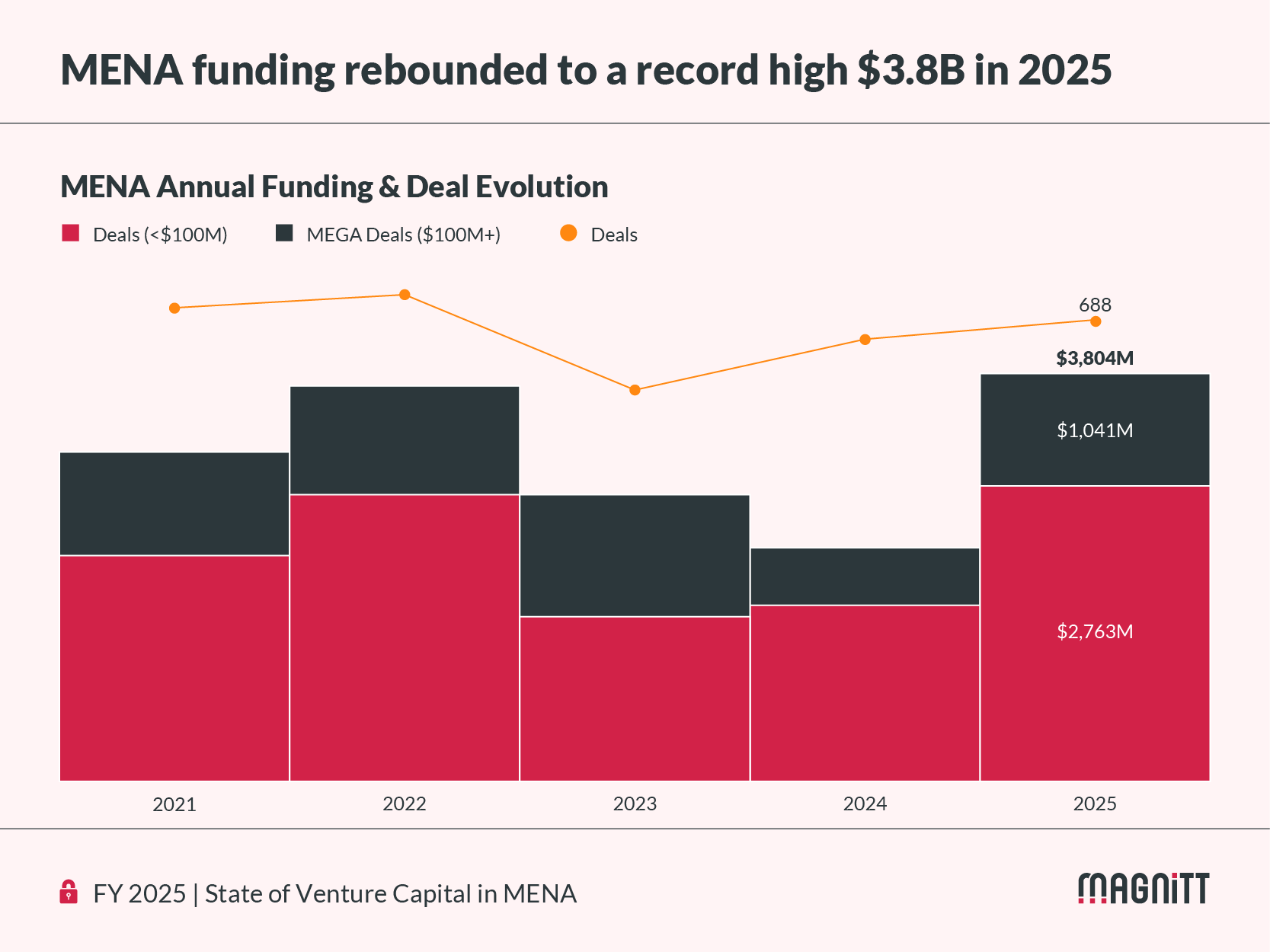

In 2025, MENA venture capital defied the global retrenchment, rebounding 74% YoY to a record-breaking $3.8B.

While other emerging economies saw double-digit declines, the region’s breakout was fueled by sovereign capital and scale-stage momentum. Saudi Arabia and the UAE remained the undisputed centers of investment, with FinTech, Enterprise Software, and AI consolidating capital as the region's most investable sectors.

Read MAGNiTT’s full report here.

Market moves: Capital activity across MENA

🇦🇪 Mal raises $230 million strategic investment round led by BlueFive Capital to support product development, licensing efforts, and market entry ahead of the platform’s planned 2026 launch.

🇧🇭 Flooss secures $22 million credit facility structured by Shorooq to scale its core Sharia-compliant cash financing products and support portfolio growth and regional expansion.

🇴🇲 eMushrif raises $7.5 million funding round led by Jasoor Ventures to support regional expansion into Saudi Arabia and the UAE and invest in product development and operational capabilities.

🇸🇦 Governata raises $4 million seed round from Joa Capital and others to support product development, enhanced AI-driven decision-making, and regional expansion.

🇸🇦 Resquad AI raises $1.5 million Seed round led by SRG to support technology development, team expansion, and regional and international growth.

🇪🇬 KNOT Technologies raises $1 million pre-seed round led by A15 to support product development, international expansion, and deeper integrations across the live events ecosystem.

Exits, liquidity, and perspectives

GCC momentum and fundraising

Dry powder and fund performance

Upcoming webinar: Building the liquidity layer for startups

Join us alongside industry experts for this upcoming conversation focused on how structured liquidity windows are reshaping startup secondaries. Our discussion will explore how entrepreneurs, boards, and investors can move from ad-hoc, high-friction transactions to repeatable, well-governed liquidity programs that balance fairness, control, and compliance.

If you are thinking about secondaries, employee liquidity, or long-term cap table health, this is a conversation worth joining.

First-time reader? Sign up here to make sure you never miss another edition.

How did we do? |