- Zest Wire

- Posts

- Zest Your Equity | 22-Nov-2023

Zest Your Equity | 22-Nov-2023

Pre-money vs post-money valuations, AI developments in the MENA region and more.

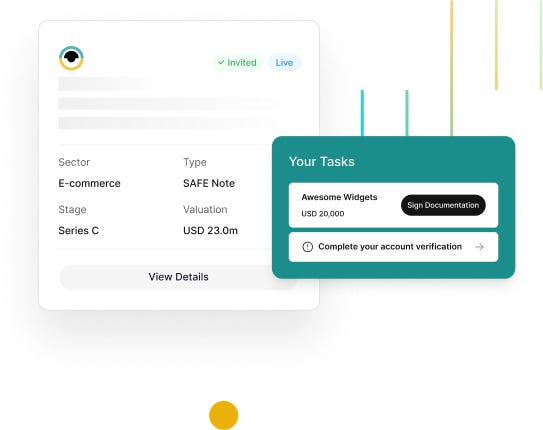

Zest is digitizing private market transactions, building tools to streamline how entrepreneurs, funds and investors transact. Our platform is designed to save you time and reduce administrative costs, simplifying the end-to-end investment process.

This week’s agenda:

Our Blog

Regional News

Startup fundraising

M&A Activity

What we’re reading

Zest updates

Media Appearances

Let’s dive in 👇

Our Blog 📚

Pre-Money vs Post-Money Valuation, what’s the difference?

When a startup raises money from investors, one of the key considerations that needs to be negotiated is the valuation of the company.

You might be wondering, what does it mean for a company to have a valuation?

Simply put, a company will have a valuation when it issues equity to investors. This is referred to as a “priced equity” round.

In a priced equity round, investors will give money to a startup in exchange for shares in the company. Each share will have a value, known as “price per share (PPS)”; therefore, the company as a whole will be valued based on the number of outstanding shares and the agreed-upon PPS.

A company’s valuation has tremendous implications for both the investor and the company’s existing stakeholders affecting how much an investor will acquire for a given investment, as well as dilution of existing shareholders, the company’s future growth trajectory, subsequent financing rounds, and more.

Valuation can be measured in terms of ‘pre-money” or “post-money” valuation – the difference comes down to when to value new investor capital.

Read our blog to understand the difference between pre-money and post-money valuation, which valuation framework is used most often, and why.

Regional News 🗞

The MENA region has shown a lot of excitement recently with the rapid development of artificial intelligence (AI) technologies, including recent funding rounds successfully closed by Intella, Pony.ai, and Maly.

While there is a lot of optimism around the technological progress that AI can create, it’s also imperative to understand the risks involved with using these new technologies and their implementation.

PwC outlines some keys risks to consider when implementing AI systems as a founder or business leader and steps you can take to address and mitigate possible inherent risks associated with these technologies.

Who’s Raising? 💰

UAE-based sustainable logistics company Wize raises $16M to deliver eco-friendly last-mile transport solutions. https://www.fwdstart.me/news/16-million-for-wize-to-deliver-eco-friendly-last-mile-transport-solutions

Saudi-based fintech startup Tamara secures $250M in debt financing to expand consumer-friendly payment options. https://www.fwdstart.me/news/tamara-secures-250m-debt-financing-to-expand-consumer-friendly-payment-options

Saudi-based proptech company Arjas raises a $28M seed round, led by Madarek International, to streamline the leasing process for commercial properties. https://www.fwdstart.me/news/28-million-for-ajras-to-streamline-the-leasing-process-for-commercial-properties

Egyptian-based fintech unicorn MNT-Halan inks $130M securitization deal from CI Capital to digitally bank the unbanked. https://www.fwdstart.me/news/mnt-halan-raises-130-million-securitisation-to-digitally-bank-the-unbanked

M&A Activity 💼

Dubai’s OSN+, Anghami to merge to create mideast streaming giant with over 120M users and $100M in revenue. Source.

What We’re Reading 📖

Zest Equity Updates 📋

Since we launched our platform, we've been making huge strides forward in our mission to digitize private market transactions. These are the values that we will continue to instill in the current ecosystem, to help empower better communication, connection and information sharing via a digitized and cost-effective manner.

Zest in the News 🚨

Want to learn more? Schedule a time with our team below!

How did we do? |