- Zest Wire

- Posts

- Zest Your Equity | 17-April-2024

Zest Your Equity | 17-April-2024

Pro-rata rights, MENA startup fundraising in Q1, and more.

This week’s agenda 📜

Zest’s Corner 📚

Startup fundraising 💰

What we’re reading 📖

Let’s dive in 👇

Zest’s Corner 📚

Pro-rata rights

During the career of a private market investor, it is likely that your ownership in certain investments will be diluted. Why?

Simply put, when entrepreneurs raise new capital from investors, new shares in a company are issued which increases the overall number of outstanding shares and decreases all existing investors’ relative ownership (more on this topic soon).

In order to maximize returns as an investor, you may want to maintain your relative ownership in a company if you believe the company can grow and achieve a meaningful exit one day.

You can do this through “pro-rata rights.” Pro rata rights give an investor the right, but not obligation to participate in future fundraising rounds in order to maintain their relative ownership in the overall company.

Pro-rata rights are a formal agreement between an investor and the company and is outlined in the transaction documentation. Importantly, not all investors are granted pro-rata rights. Typically, only certain investors are granted these rights and must earn them by showing the company how valuable they can be on the cap table.

Pro-rata rights are beneficial because they give an investor an opportunity to double down on their “winner",” the companies that have performed the best since your last investment.

For companies, entrepreneurs will grant pro-rata rights as a sign that they want certain investors to invest in future rounds. This also gives new investors a positive signal that existing investors would want to invest additional capital into the company.

Our newest blog is on the concept of equity dilution and will be released soon 🔥

Startup Fundraising

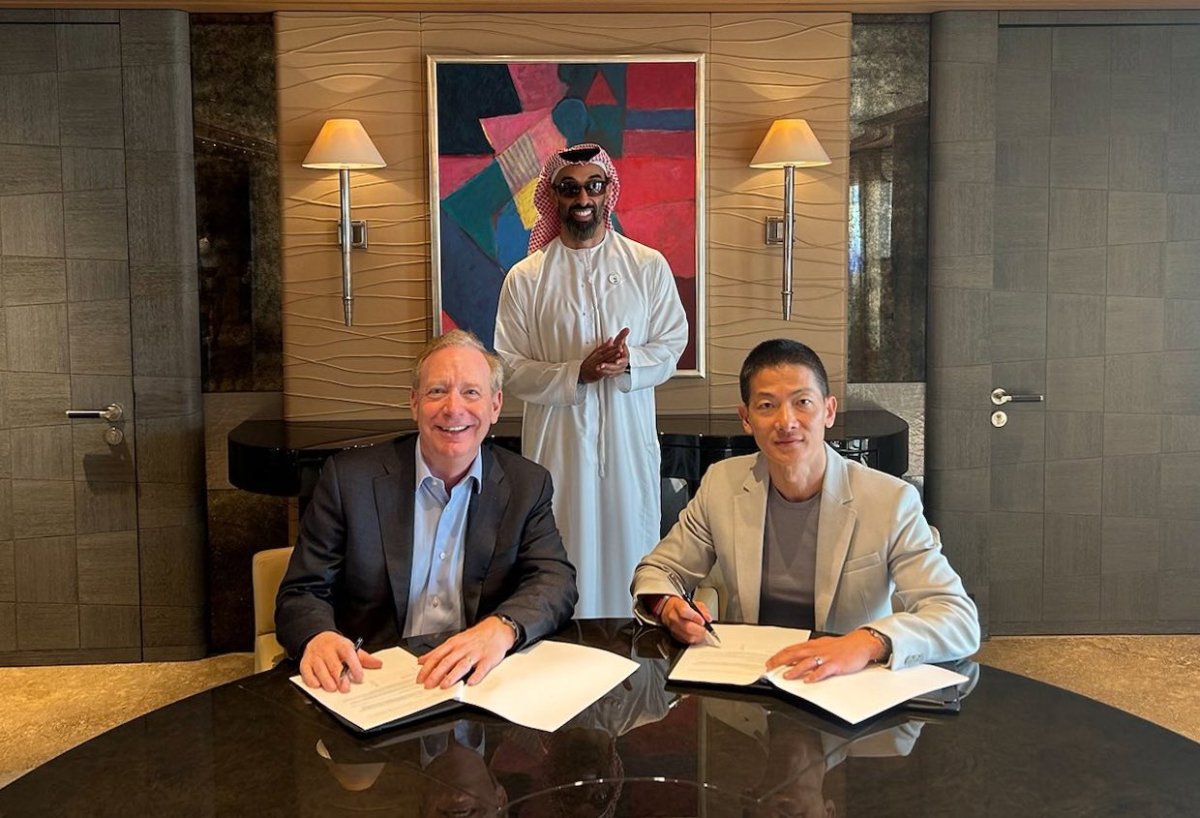

🇪🇬 UAE-based fintech Fortis has closed a Series A funding round at $20 million from Opportunity Venture.

🇦🇪 UAE-based Web3 services provider U-topia has raised $850,000 in funding from GDA Capital.

🇱🇧 Lebanon-based agritech Garbaliser has secured a $436,000 investment from Shark Tank Dubai for a 12 per cent stake in the company.

🇸🇦 Saudi Arabia-based SaaS provider Penny Software has raised a pre-Series A funding round for an undisclosed value, from Iliad Partners, joined by GSI and US-based Knollwood Investments

🇧🇭 Bahrain-based financial marketplace Daleel has secured an undisclosed investment round from Hambro Perks Spring Studios.

🇴🇲 Oman-based adtech Mubashir has raised an undisclosed investment round from ITHCA Group.

What We’re Reading 📖

Eid Mubarak from all of us at Zest.

Wishing you and your loved ones had a blessed Eid ✨

How did we do? |